Join us for a live webinar this month!

As we approach Election Day, investors are understandably wondering– and maybe even anxious–about how the U.S. presidential election will affect the stock market. This year, COVID-19 and a fragile economy are additional concerns to the U.S. election cycle.

Regardless of who ends up winning in November, the election will likely play a factor in the markets. Here are a few things investors should consider:

Dealing with uncertainty: There are many important issues at stake, including trade, healthcare, tax policies, social justice and our relationship with China. While the economy is a significant influence to the elections, the COVID-19 pandemic has added even more uncertainty. How long the virus will persist and how significant the impact on economic growth will be remains unclear at the moment.

Even without these usual circumstances created by the pandemic, it isn’t uncommon for the stock market to exhibit a degree of volatility in the run-up to an election. Investors should be prepared for circumstances where the “noise” generated by the campaign contributes to market fluctuations.

It’s not just about the president: It’s true that our president has tremendous influence in the direction our country takes. Regardless of who wins, what is accomplished is influenced quite heavily by House of Representatives, Senate, local and state legislatures, Federal regulators, and the health of our nation.

Is history a guide?: Historically, market volatility begins to rise about 45 days ahead, or roughly three weeks into September, before peaking one week before the election. In instances where control of the White House changes parties, stock market volatility tends to increase.

Interestingly, there has been very little difference in the performance of the economy under Democratic and Republican presidents since 1977. According to recent analysis by Deutsche Bank, “The average growth rate for a Democrat President is 2.9% compared to 2.7% for a Republican President.”

It’s speculative to try and predict the outcome of the election. More important to the markets as whole are the real drivers of economic growth and corporate profits. Policy changes contribute to this, but in this case, a return to a new normal after a vaccine is likely a bigger contributor in the coming year.

What’s this means for your finances?: While it’s natural to think about the impact of the election on your investments, it’s only one factor. Stay focused on your long-term goals. Review your portfolio diversification and risk tolerance with a financial advisor for an objective perspective on your financial situation.

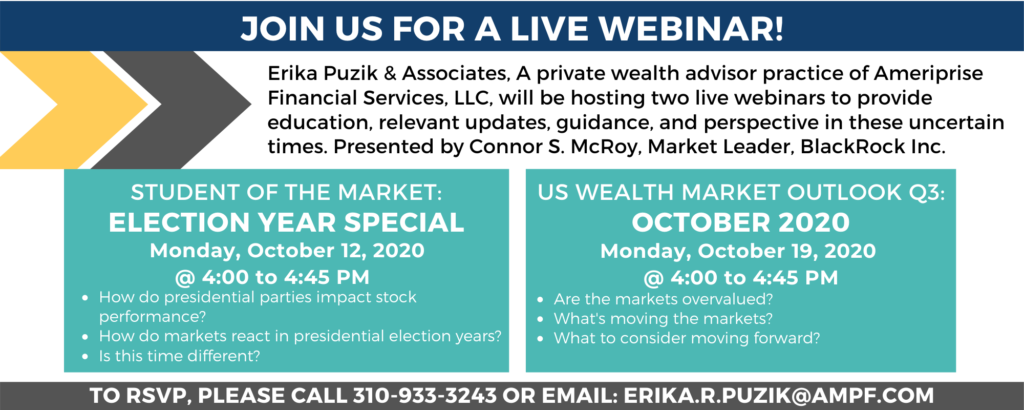

Join us for a Live Webinar

Sponsored post content. Posted October 2020.